Nitesh Jain, Director, CRISIL Ratings Limited

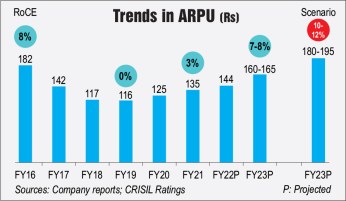

The recent tariff hikes have given rise to many questions on their impact and significance and whether they are enough. It is a tale of contrasts. India has the second highest average data traffic per user globally, and among the lowest average revenue per user (ARPU) per month. The intense price wars of 2016-19 led to a sharp decline in ARPU just as data consumption went off the charts. The ARPU declined from Rs 182 to Rs 116 while data usage per subscriber per month surged to around 12 GB from less than 1 GB during the period. Return on capital employed (RoCE), an important metric to assess long-term business viability and investment decisions, slid to almost zero in fiscal 2019 from 8 per cent in fiscal 2016.

Telcos initiated broad-based tariff hikes in December 2019, which boosted ARPU to Rs 135, while data usage per subscriber per month climbed to around 14 GB in fiscal 2021. However, the sector was dealt a big blow towards the end of 2019 when the government demanded adjusted gross revenue (AGR) dues of over Rs 1.2 trillion. The crystallisation of sizeable AGR liabilities negated the expected improvement in RoCE from tariff hikes.

The sector has been in repair mode since then, revising tariffs selectively to dial up ARPU. However, companies had shied away from a major tariff hike for prepaid plans until the last week of November 2021, when a telco announced tariff hikes for its plans by 20-25 per cent, followed by the other two major telcos. Tariff hikes and ongoing customer upgrades led by the continuous rise in data consumption will improve ARPU by around 20 per cent to Rs 160-165 next fiscal from around Rs 135 in the previous fiscal.

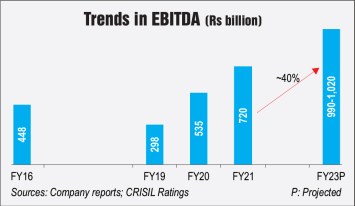

ARPU growth will lead to non-linear growth in profitability due to the high operating leverage of the telecom sector. The sector’s earnings before interest, tax, depreciation and amortisation (EBITDA) are expected to surge around 40 per cent to approximately Rs 1 trillion in the next fiscal from Rs 720 billion in the 2021 fiscal (see Graph 1). Furthermore, the four-year moratorium on government dues recently announced by the union cabinet could provide an annual cash flow relief of approximately Rs 320 billion to telcos that have opted for it. Debt in the telecom sector increased to about Rs 4 trillion as of March 31, 2021, from around Rs 3.3 trillion as of March 2020 because of the large unpaid AGR dues. The debt is expected to rise to around Rs 4.6 trillion in the current fiscal because of additional liabilities pertaining to spectrum purchased in the March 2021 auction.

The debt to EBITDA ratio should remain largely stable at 4.1. The ratio could improve to 3.8 next fiscal and could even be below 2.5 for the top two players, owing to full-year benefits of tariff hikes and equity infusion.

The improvement in EBITDA will enable telcos to invest in the roll-out of 5G mobile service networks over the medium term. Key players have invested around Rs 5 trillion in 4G services between fiscals 2017 and 2021, and will now need to invest further for 5G. Even prudent bidding at the 5G spectrum auction likely next fiscal would require an investment of at least around Rs 700 billion, assuming telcos will follow a calibrated approach initially and buy 5G spectrum only in metros and Category A circles, where data consumption is high. The estimated investment is as per the current reserve prices recommended by the Telecom Regulatory Authority of India for 5G spectrum bands, assuming the top two telcos would buy out the entire 100 MHz spectrum in each of the metros and Category A circles.

In sum, the adverse triad – large capex, low ARPU and sizeable AGR liabilities – resulted in the sector’s RoCE sliding to around 3 per cent in fiscal 2021 from about 8 per cent in fiscal 2016. While the recent tariff hikes will increase the RoCE to 7-8 per cent, the sector will need an ARPU of Rs 180-195 (see Graph 2) to improve the RoCE to 10-12 per cent. That said, any intense bidding for spectrum beyond the metros and Category A circles, and more-than-expected investment in fiberisation for 5G, could have a bearing on credit profiles.