Finolex Cables, a leading manufacturer of electrical and communication cables, has been the pioneer in this segment in India. The company is among the largest manufacturers of optical fibre cables (OFCs) in the country. Its wire and cable products are used in applications such as automobiles, lighting, cable television, telephones, computers as well as industrial applications.

Finolex Cables, a leading manufacturer of electrical and communication cables, has been the pioneer in this segment in India. The company is among the largest manufacturers of optical fibre cables (OFCs) in the country. Its wire and cable products are used in applications such as automobiles, lighting, cable television, telephones, computers as well as industrial applications.

In 2020, the company ventured into manufacturing electric components such as switches, electric circuit boards, fans, lightings and water heaters. This proved to be beneficial for the company as it clocked around Rs 2 billion or about 5 per cent of its revenue from these segments during the past fiscal year.

Going forward, Finolex will eye opportunities thrown open by India’s transition to 5G and the government’s thrust on hastening digital connectivity.

Financial highlights

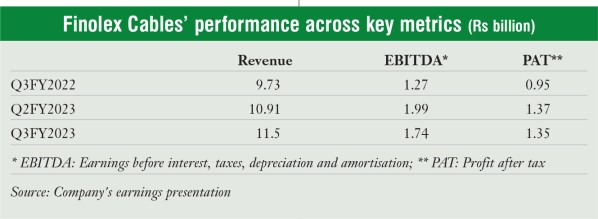

The company has been reporting a steady financial performance. During the quarter-ended December 2022, Finolex’s revenue stood at about Rs 11.5 billion, about 18 per cent higher than that during the corresponding quarter in the previous year and about 6 per cent higher than that in the preceding quarter. For nine months ended December 2022, the company’s revenue stood at Rs 32.56 billion, up from Rs 25.82 billion during the same period in 2021.

Profits for the quarter-ended December 2022 stood at about Rs 1.35 billion, up from Rs 0.95 billion, a year ago. For nine months ended December 2022, profit was about Rs 3.67 billion, up again from Rs 3 billion, a year ago.

Communication cables segment

As far as the company’s operations in the communication cables segment are concerned, revenues from metal-based cables were up by about 40 per cent during the quarter-ended December 2022, whereas the OFC segment’s revenue grew by even higher percentage. Further, the volume of metal-based products improved by 27 per cent during the quarter and OFC volumes grew by over 70 per cent.

Of the total communication cable sales, approximately two-thirds are fibre related. In terms of sales, Finolex’s major product sales in the communication cables segment have been to non-government agencies. Government agencies did not account for large product sales as Finolex won just one tender by Bharat Sanchar Nigam Limited (BSNL) during the past nine months. However, it expects large buys of cables by BSNL and the Department of Telecommunications in the coming months to drive future business in this segment.

Capacity additions

Finolex’s products are manufactured at its five plant sites. The company is adding capacity at its cable plants in Goa and Urse, in Maharashtra. According to the company, capacity addition is more or less completed at these two plants. Further, an additional line is being installed on Finolex’s optic fibre plant.

Future growth momentum

Future growth momentum

In future, the company is positive of driving synergies from various government initiatives. For one, the Union Budget 2023-24 has allocated Rs 21.58 billion for setting up an OFC-based network for defence services and Rs 7.15 billion for telecom projects in the North-eastern states. This is expected to drive demand for its OFC cables in the coming months.

Further, the government’s increasing thrust on escalating BSNL’s 4G upgradation and 5G roll-out, continued 5G roll-out in India and the accompanying need for scaling up fibre is expected to drive Finolex’s business growth.

Moreover, the company believes that the government’s plan to set up 100 labs for developing applications using 5G services in various engineering institutions across the country and three centres of excellence for artificial intelligence will help it in realising a new range of opportunities and increase the demand for OFCs. The rising demand for data centres in the country is also expected to drive growth of not just optical fibre, but also other products that the company produces.

Riding high on India’s 5G wave, the Pune-headquartered company is positive about clocking around Rs 110 billion in revenue by 2028.

Kuhu Singh Abbhi